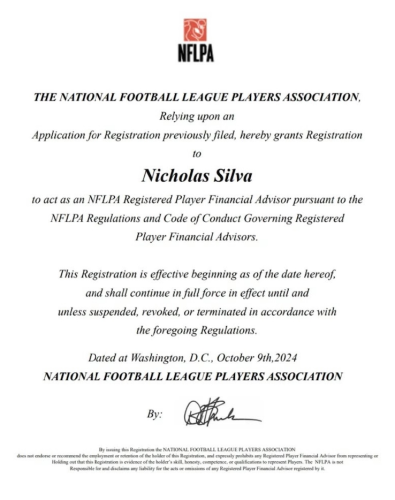

THIS PAST AUTUMN (2024) Nick Silva, owner and co-founder of ProWealth LLC, a CERTIFIED FINANCIAL PLANNER™ and Chartered Financial Consultant® was accepted into the prestigious NFLPA’s (National Football League Player’s Association) Registered Player Financial Advisors Program.

Over the course of his illustrious career, Nick has been recognized in THE WALL STREET JOURNAL, FORTUNE MAGAZINE, and FORBES MAGAZINE as a ‘Five Star Wealth Manager you need to know’ by Five Star Professional*. He has also been awarded Boston Magazine’s Five Star Wealth Manager Award* for eight years in a row.

Nick has been practicing in financial services for 15 years, carving out a lane for himself by specializing in work with high income/high net worth athletes, physicians, entrepreneurs, and real estate owners.

For this issue of BostonMan Magazine, we had the pleasure of catching up with Nick to discuss the NFLPA and much more!

BMM: Thanks for taking the time to speak with us Nick. To start things off, tell us a little about yourself and how you got into finance?

NS: First off, thank you for taking the time to speak with me. I really appreciate it.

Well, it’s funny as it relates to this interview. As a child I always wanted to be a professional athlete. I worked hard trying to achieve that dream, but of course fell short playing Division II lacrosse at Bentley University. I love sports, I always have, and they were always a big part of my life. My brothers and I were super competitive growing up, playing multiple sports, and all of us playing in college. I love the team dynamics, health benefits, and especially the competitiveness. They’re still a part of my life…Much to my wife’s amusement, I still train diligently in the gym and still play in competitive men’s basketball and flag football leagues… she doesn’t get it—but I’m not stopping! I’ve also picked up golfing over the last few years, much easier on the knees carrying all this weight around!

Now, how I got into finance, my back up plan when the pro athlete dream didn’t turn out ha-ha…So Economics and finance became another passion of mine, beginning in my teenage years, which I would say was sparked by seeing my parents struggle with money and with money decisions. This passion was later solidified by my high school Economics class taught by Mrs. Gamer, …I was fascinated by how the whole money ecosystem worked, eager to learn as much as possible so I could give myself every advantage. I later realized I could use this knowledge to help my family and others. Hence it was easy to pick my Economics & Finance major at Bentley and come to the realization that I wanted to help people achieve better lifestyles through better money decisions. While I believe it’s true that money doesn’t directly lead to happiness, having the financial security in place to do the things you enjoy, free up time to spend with the people you want to be around, and protect and help your loved ones, can certainly lead to more happiness. I love what I do, and although there were certainly tough times in the early stages of my career getting things off the ground (a lot of learning experiences) …I worked my tail off to get where I am at, and I wouldn’t change anything about my journey.

BMM: Your approach to managing portfolios and money is very transparent and relationship driven with your clients. What is it about your style that you find most effective and has been the key cogs to your success?

NS: Well, I’d say mainly three things:

First is our comprehensive team approach. There is a different level of planning when it comes to high net worth and ultra-high net worth. Our clients need a lot more than a portfolio manager, and that’s where we come in. We are their go to advisor, positioning ourselves as a one stop shop, with family office services and quarterbacking all things to do with a dollar sign, working with the other advisors on the team. Our role is similar to a CFO type role, helping make sure every aspect of their financial strategy is as efficient as possible to get them where they want to go. There’s a perfect sports analogy for this… They own the team and I’m the quarterback/coach making sure the best players are on the field to execute the best game plan. And just as importantly, making sure we are getting everything out of the players in their roles, assuring they’re doing their job. Let me give you an example… some of the more important players we work with are the accountants & attorneys. Sometimes clients already have good ones but many times they don’t, so we make sure this is taken care of. For the example here’s a quick story on making sure we’re getting the most out of all the players… We run this annual tax report for all our planning clients to make sure they’re not missing any potential tax saving opportunities- which also makes sure the accountant is doing everything they’re supposed to be doing… so just the other day we run it and find that along with missing a bunch of obvious business deductions, the accountant wasn’t even deducting their service fee. Once the client saw this on the consideration section of the report, they were shocked and ready to move on to a new accountant for which we of course made the intro to one of the all-star accountants in our network. Tax cost is by far the biggest cost for these high income/high net worth clients, so we need to make sure we are working with a capable CPA when we implement our tax strategy for clients, as this is a big area of focus. We need a capable CPA involved since we do not provide direct tax, or accounting advice. So, clients, with or without us, need to consult with a credible tax accounting professional before making any tax decisions. For our planning clients, we quarterback this with periodic meetings that include their own accountant or one of the ones we introduce them to. We spend a lot of time on the tax strategy… including tax diversification, identifying tax optimizing opportunities, and tax reduction strategies. As I just mentioned, taxes typically end up being the biggest cost for these clients, so a big impact can be made here.

This brings me back to the comprehensive team approach. Tax planning, wealth transfer, investment management, business planning (LLC, S Corp structure etc.), Insurance planning, loan and credit management, pension maximization, social security optimization, areas that are harder to find expertise on, we have an exceptional in-house and extended team of ‘A players’ to make sure all these important and impactful areas are covered.

Next would be listening… Listening, understanding, and being able to relate/ have common ground with my clients. Asking the right open-ended questions and then just listening intently. Listening to what and who they care about, the kind of ideal lifestyle they want to achieve, and understanding and being able to relate to their concerns and pain points. The reality is that most of my clients have similar concerns, and pain points I have experienced myself, so it is not hard to relate. Many clients that I originally met as a client/advisor relationship have actually become good friends over the years, as the relationship grew far past financial planning. People who love their family, have high income/ high net worth mostly have similar concerns- I would say typically the following big ones: They want to pay less tax, They want to free up more time, they want to protect and open doors for loved ones, and they want to get to all the opportunities they may be missing ( …that fear of missing out, ‘FOMO’, usually because they don’t have the time or mental energy to get to all of it). That’s where we come in, it’s all we do all day every day, it’s all I read about, and just like they are some of the best in the world at their craft, we like to see ourselves as one of the best in the world at our craft.

So, asking the right open-ended questions and then just listening intensely. This allows us to really understand their goals, understand who and what is important to them, repeat this back to them in their words so they know we get it. And then, as Carl Richards’ would say, the real financial planning is making sure that their capital (not just money, but time and energy as well) is in constant alignment with these goals, lifestyle, and people they care about.

Last but certainly not least is Relationships, which you bring up. This is a huge one. As I mentioned before many clients have become friends over the years, I golf with a bunch of them all the time. I’m very open with my clients when it comes to my lifestyle, my goals, and even my financial planning strategy. I’m a big fan of eating my own cooking so I will always open-up with what I am doing with my own money. When clients get to know you, especially on the personal side, there just seems to be a better trust factor in play. This all helps build better relationships with our clients since it’s not just a one-way street where client shares to the advisor, but a mutual share or 2 way street when it comes to lifestyle, goals, family and financial strategy.

Relationships with other expert professionals, or what I refer to as ‘A player’s, is another big value add and keys to our success. My circle and network is extremely valuable, and my clients gain access to it which brings them additional value. These are other professionals the clients need access to if they don’t already have an A-player on their team, such as CPA’s, attorneys, loan officers, real estate professionals, marketing/brand managers, agents, business/life coaches and many more. My strongest relationships are with what I call the staple positions, CPA’s, Attorneys, and Real Estate Professionals. It’s obvious why the CPA and attorney are important from a tax saving and asset protection standpoint, but I love real estate, and many athletes and clients are interested in getting involved in some sort of real estate endeavor. I am a well-seasoned real estate investor myself with ownership in over 35 units across 6 properties and have experience with all sorts of investment real estate endeavors. From this, I have built many valuable relationships and have connections with brokers, agents, loan officers, banks, management teams, to independent contractors, and more. This is the value for my clients, I can connect them with these trusted experts to advise on these matters and then coordinate and factor all of it into the planning we do for them. Many of my clients are already in the real estate game and many are business owners and even some creators as well. Many of these athletes should consider things like investing in real estate along with owning stocks and bonds, and even consider creating their own business or businesses to build and market their brand. All these strategies will lead to more sustained income and wealth after retirement, which is where most athletes see that huge drop in income when they’re done playing. My circle is filled with the right professionals to help us help them find their best opportunities from income, business, tax, asset protection and investment perspectives. Building these rockstar relationships over the years has been a huge value add for us, as it is a great and trusted client referral network. But just as so for our clients, as they have access to this circle and network. Opportunities come through all the time just from getting the right people talking together in a room, or now a days, on a zoom together.

BMM: Congratulations on your recent CERTIFICATION as a REGISTERED PLAYER financial advisor with The National Football League Players Association. Can you tell us a little bit about this program and what it entailed to be accepted into it?

NS: Thank you Matt, appreciate that.

And, yes of course. Well first, the NFL Players Association (NFLPA) as you know is a labor union representing the players. It assists players with collective bargaining, contract & legal representation, player education (they do a great job of this), player advocacy, safety, and much more.

The NFLPA’s Registered Player Financial Advisor Program is a certification program designed to help make sure that players have access to qualified and trustworthy financial advisors who are capable of handling high income/ high net worth clientele, along with the unique financial circumstances pro athletes face. The program sets standards for education, experience, and ethics for the advisors. By mandating their own strict code of ethics and conduct requirements, and requiring advisors to meet certain standards, the NFLPA helps make sure players have the opportunity to work with qualified and ethical advisors. They also provide the registered advisors with ongoing education on the unique financial challenges faced by NFL players, such as short career spans, fluctuating income, fraud/scam targeting, and unique complex tax implications.

In summary, the Registered Player Advisor Program is a valuable resource for NFL players, helping connect them to the right advisor who can then help them make informed financial decisions and protect their assets and their future.

As far as what it entails to be accepted into the program, you have to go through a strict and thorough certification process designed to ensure that you are qualified and trustworthy to work with the players.

First, you need to meet the eligibility requirement to even apply, which includes holding bachelor’s degree from an accredited university, being a CERTIFIED FINANCIAL PLANNER™ (CFP®) and/or a Chartered Financial Analyst® (CFA), having a Minimum of eight (8) years of licensed experience, holding adequate Fidelity bonding and professional liability insurance coverage. You must have No civil, criminal or regulatory history related to fraud. No pending customer complaints or litigation. You must not maintain custody of player funds unless deemed a qualified custodian. You must also submit an application fee.

The application process itself is lengthy and covers items such as relevant experience working with high-net-worth clientele & professional athletes, providing references, client profiles including assets under management tiers, a thorough background check, regulatory and compliance check, credit check, financial disclosures, professional qualifications, financial planning services, and more.

They’re big on ethics, as they should be, given some players history with financial professionals or those that call themselves financial professionals.

Once registered, you need to follow their rules, code of conduct, and educational requirements such as attending the NFLPA advisors conference and completing NFLPA approved continuing education webinars or courses.

In summary, the NFLPA Registered Player Financial Advisor Program is a demanding certification program that requires a combination of education, experience, and ethical commitment. That being said, it’s truly a great program and resource for the players to get the unique advice, care, and services they need from a trustworthy source.

BMM: What types of professional athletes are you looking to work with; and ‘Why you’? WHY WOULD THEY BENEFIT FROM WORKING WITH YOU?

NS: Well let me start with why us, or even someone like us. Unfortunately, our industry is very loose on who they allow to call themselves a ‘financial advisor’. Great financial advisors certainly do exist, but just like a great accountant, they are hard to come by. Over the years I came to find that many prospects I met were being significantly underserved and even overcharged for what they were getting, with some even having received just bad or incorrect advice. They weren’t getting the service and attention to detail they needed, even within the portfolios, never mind all the other big impact items that were being overlooked. With us, our services extend far beyond the portfolio, some of which are arguably more impactful, for example; tax reduction strategies, family and income protection, insurance planning, business planning, estate planning, and exit/retirement planning.

Athletes face convoluted tax implications with the Jock tax, signing bonuses and contract structure (which they can many times spread out and/or receive in tax favored residency state if feasible), implications related to where they perform their work and have their residency, where they report for duty days and media days and more. Most advisors are not too familiar with these unique tax implications. Athletes face many other unique challenges outside of the tax box as well. Most will face a shorter career span (so the big chunk of earnings happens only over a few years), large income fluctuations, Injury and hence income risk, peer pressure to spend and lifestyle creep (buying luxury items and getting used to a luxury lifestyle even after the playing income stops), getting targeted by scammers and fraudsters, receiving bad ‘get rich quick’ financial advice from others, exit/retirement strategy, family/friends asking for money, potential legal and health challenges, and more. We are here to educate the players on how to handle all of this and help them understand and implement strategies to help mitigate all the risks associated with these challenges.

As I mentioned before, we help with all things to do with a dollar sign, either directly or through collaboration with other professionals in our trusted network. Tax strategy and analysis is a big one of course, but to name a few others: Cash & portfolio management (including direct indexing; a portfolio strategy that is seldom available but creates more tax loss harvesting opportunities), Insurance & Income protection (as mentioned athletes face unique injury risk), estate planning, retirement/exit strategy, business planning, real estate, debt and credit management, understanding alternative investments- including private equity and private debt, , and more… down to every day decision making with our software that allows us to input live scenarios into their financial plan to see the effects of the scenario if they were to implement them…this leads to smarter, more informed decisions. Our areas of expertise are what make the most impact for these players and they’re always going to get the attention, professionalism, and the ‘Ritz Carleton’ white glove’ service they deserve.

We have a clear and concise way of portraying our value, both qualitative (less money induced stress and anxiety knowing we’re taking care of everything, not missing any opportunities each year, and opening up doors to new opportunities) and quantitative (estimated additional earnings and tax savings compared to their current strategy). You know, true cost is not the fee you pay, it is the value gained minus the fee. Many people place higher value on the qualitative side (less worry), but even if we look only at the quantitative side… For example, if I pay one CPA $1,000 where I get no tax savings vs paying another CPA $5,000 where I get $40,000 back in tax savings… First option I’m out $1,000 second one I’m up $35,000, even though the second one had the higher fee. Affluent people understand this and can see the value in what they pay for and invest in. Working with us, partnering with our team, clients are investing in themselves and their futures.

Just as important, as it is to all high-net-worth families who have larger amounts invested, working with us, we have all the structures in place that a high net worth professional would want and need with our large institutional backing. When clients invest with us, our RIA platform is Eagle Strategies LLC, which manages over $20 billion in AUM (as of December 31, 2023) and is wholly backed by a fortune 100 company, New York Life, who has over $30 billion in reserve surplus on their balance sheet. Affluent professionals prefer to invest with larger, more established firms with strong backing and balance sheets, rather than investing with smaller firms and banks who are at more risk of going under, especially since FDIC insurance only covers $250K per account holder and SIPC insurance only covers $500K with up to $250K of that in cash per account holder. These individuals are typically investing far more than those coverage amounts, so this is a big deal as it adds another layer of security.

To address the first part of your question, we want to work with athletes who want to excel in life beyond the field including after their playing years, who value family, and who want to learn and invest in themselves and their futures. Especially the younger ones starting out, since this is where we see players make the biggest mistakes.

We have a way of communicating with these athletes and with all our clients, avoiding the industry jargon, so they can understand the advanced techniques and strategies. We break advanced techniques down in a clear, concise manner to portray how the strategies can positively affect, and protect, them and their families.

I love working with athletes, I admire them, I grew up idolizing them as sports were such a big part of my childhood and throughout my life. I admire the hard work and sacrifice they put in. Some of my best memories were playing sports and even watching them. I’m a die-hard sports fan. Growing up in Boston, I cherish memories watching the Patriots win Super bowls during the Tom Brady era, and never miss a Celtics game… since I was a young child I remember watching with my grandfather and father since the Bird era. My father would show us tapes of Bird and Jordan as we learned to play basketball. Sports were and are a staple in my life and that’s why I plan on playing as long as I can. I’m excited for my kids to have sports in their lives, to learn team dynamics and other values that are applicable in all aspects of life…(they are still a little too young, but soon enough).

From the earlier part of my career, I was trying to tap into this market as I started to uncover a huge gap with high-net-worth clients I took on who clearly needed additional services, assistance and attention to detail they were not always getting. And as a former college athlete I can relate to a time when I was prioritizing athletics and training. Look what these athletes put their bodies through, especially in the NFL. The dedication and commitment that goes into being experts at their craft… Not only is this time consuming, but mentally and physically draining as well… so it is not easy for them to go out and learn all this stuff on their own. Especially younger professional athletes or even college athletes who are being endorsed before they get to the professional level. They’re at a point where the education & guidance is crucial at that young age where many players have got themself into financial trouble, and later wish they had done things differently. If they had just had the right structure and access to a proper advisory team, things would have turned out different.

After years of experience working with high income and high net worth clientele, my partner and I came up with the name ProWealth LLC when we decided to join forces early in 2020. We wanted the word ‘pro’ in there for a reason. Our practice was geared toward working with affluent professionals and professional athletes. We also liked that P-R-O could be used as an acronym for PROTECTION, RETIREMENT, and OPPORTUNITY, which encompasses much of what we do.

BMM: Looking into your crystal ball, what do you see for Pro Wealth and yourself in 2025 with the NFLPA?

NS: Helping way more current players, especially the younger ones (as early as college, even high school) … helping them grow and growing with them. Empowering them with the knowledge, resources, and team to get them the financial security they need and open doors to other new and exciting opportunities for them. Helping them navigate the proper lifestyle balance as they will have a lot of people in their ears and outside influences. Making sure they weed out the garbage and focus on what actually matters.

As one of their primary gatekeepers, help safeguard them from fraud, scams, and the too good to be true/get rich quick schemes. And instead put the odds way in their favor with a long-term strategic plan that also allows flexibility for major life changes. We want to grow our active athlete client base, help them grow on and off the field, and as mentioned before, grow together.

The vision is to be THE GO-TO ADVISOR for professional athletes in the new England area and beyond within 3 years.

BMM: Thank you Nick, it has been a pleasure speaking with you.