About the author: Nick is a comprehensive financial planner*with over 10 years of experience and the author and founder of “My Two Cents” personal finance commentary. He was featured in Forbes Magazine and the Wall Street Journal as a Five Star Wealth Manager by Five Star Professional**in 2018 and 2019. During his free time, he enjoys playing basketball, golfing, and fishing. It’s not what you make, it’s what you keep.

Almost everybody I run into is concerned with their investment returns, yet few pay attention to how taxes may affect those returns.

If you are a good saver, experience decent returns and build up a nice retirement portfolio, you run the risk of falling into a high tax bracket during retirement. This is especially true if you plan to live off of a generous income stream from that portfolio. Having been a hard worker and good saver, wouldn’t you want to keep as much of your savings and investment gains as possible?

Similar to the well-known strategy of asset diversification1, which may reduce return risk, the lesser known strategy of tax diversification may help to reduce tax risk. Establishing a tax diversified strategy means having different investment buckets with different tax treatments.

Let’s review three different types of investment tax treatment along with some well-known examples of each:

1) Taxable –1099 NOW-(i.e. Savings, CDs, real estate, business income, and non-retirement investment accounts)

2) Tax Deferred –1099 LATER-(i.e. 401(k)’s, IRA’s, Annuities, and other deferred compensation plans)

3) Tax Free Income –1099 NEVER-(i.e. ROTH Accounts, 529 Plans, Cash Value Life Insurance, and Municipal Bonds

*Please note, you cannot have all three in any 1 account, however, by establishing multiple savings vehicles you can incorporate all three into your overall retirement plan

Although the third one may catch the eye at first, the reality is that some mixture of all three is usually best. A mixture can give you the opportunity to lower taxes both before and after retirement. This strategy can lower your annual effective tax rate and help you keep more money in your pocket.

So, you may be wondering, “what is the right mixture?” Well, like most financial strategies, this will be different for different people and will depend on many factors, such as your adjusted gross income, life stage, and the retirement vehicles available to you.

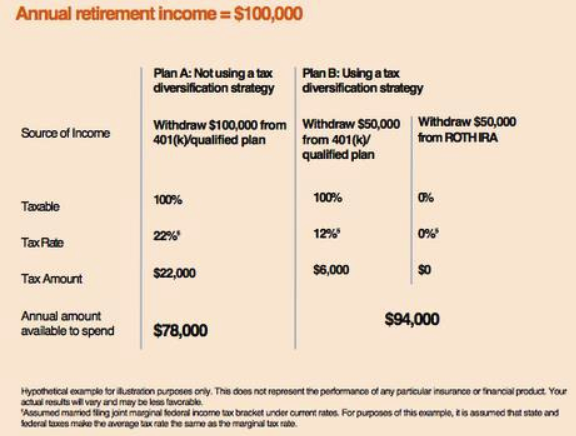

Let’s now take a look at the potential impact of tax diversification in a hypothetical example:

As you can see from this example, tax diversification can help you better manage your tax liability in retirement, allowing you to keep more of your retirement savings.

The future is unknown, but here are some factors to consider when thinking about taxes in retirement:

1) While uncommon, your tax bracket could actually be worse in retirement than it is now.

2) You will likely have fewer tax deductions available, meaning less ability to control your tax bracket in retirement.When you are fully retired you can no longer contribute to a tax deferred retirement plan (i.e., a 401K), will likely have little or no mortgage interest to deduct, and no more child tax credits since your kids are likely grown.

3) With proper planning, you can minimize the effect taxes could have on your retirement plan.Ideally, you would like to establish a retirement plan that includes three key attributes: 1)Contributions that are tax deductible 2) Accumulation that is tax deferred and 3) Distributions that are tax free

Given these factors and the unknowns of future taxes, tax diversification may prove prudent. Investments with different tax treatment can increase your flexibility to handle various tax outcomes. Strategic withdrawals from the different investment buckets can also help to reduce tax risk and help you keep more of your hard-earned money.

**

Nicholas A. Silva is a Financial Adviser offering investment advisory services through Eagle Strategies LLC, a Registered Investment Adviser& a Registered Representative offering securities through NYLIFE Securities LLC, Member FINRA/SIPC, A Licensed Insurance Agency, 201 Jones Rd 5th Floor, 781.392.1767.Eagle Strategies LLC & NYLIFE Securities LLC are New York Life Companies. Neither NYLIFE Securities or Eagle Strategies LLC is affiliated with Five Star Professionals. Please see disclosure below for complete description on research methodology employed by Five Star.1Asset Allocation does not ensure a profit or protect against a loss butis intended to help manage your goals and risk tolerance.2Certain interest, although exempt from federal income tax, may still be reportable to the IRS and, in certain circumstances, may be subject to the alternative minimum tax (AMT).3The primary purpose of Cash Value Life Insurance is to provide a death benefit. Cash Value Life Insurance is not a retirement account, unlike a Roth IRA. Cash Value Life Insurance is not an interest-bearing debt obligation, like a Muni Bond. However, Cash Value Life Insurance does offer tax-free access to the cash value, whereupon withdrawing the cash value will reduce the cash value and death benefit.4Municipal bonds may be subject to alternative minimum taxes. Also, Municipal bonds, if not in the state of domicile, may be subject to a state income tax.The information provided is general, educational and not intended as an offering of any specific products or services, nor considered as specific investment, legal or tax advice. Individual situations can vary, and an individual assessment to your specific situation should be used.Please note that redistributing assets among the “buckets” may trigger tax consequences. For example: selling assets in the taxable bucket in order to invest in assets in the tax-deferred bucket could trigger capital gains taxes. Please consult your tax advisor for advice before taking any action.Neither Eagle Strategies LLC norany of its affiliates, employees or Financial Advisors nor Nicholas A. Silva or staff provides tax, legal or accounting advice.Please consult your own tax, legal or accounting professional before making any decisions.**The Five Star Wealth Manager award, administered by Crescendo Business Services, LLC (dba Five Star Professional), is based on 10 objective criteria. Eligibility criteria –required: 1. Credentialed as a registered investment adviser or a registered investment adviser representative; 2. Actively licensed as a registered investment adviser or as a principal of a registered investment adviser firm for a minimum of 5 years; 3. Favorable regulatory and complaint history review (As defined by Five Star Professional, the wealth manager has not; A. Been subject to a regulatory action that resulted in a license being suspended or revoked, or payment of a fine; B. Had more than a total of three settled or pending complaints filed against them and/or a total of five settled, pending, dismissed or denied complaints with any regulatory authority or Five Star Professional’s consumer complaint process. Unfavorable feedback may have been discovered through a check of complaints registered with a regulatory authority or complaints registered through Five Star Professional’s consumer complaint process; feedback may not be representative of any one client’s experience; C. Individually contributed to a financial settlement of a customer complaint; D. Filed for personal bankruptcy within the past 11 years; E. Been terminated from a financial services firm within the past 11 years; F. Been convicted of a felony); 4. Fulfilled their firm review based on internal standards; 5. Accepting new clients. Evaluation criteria –considered: 6. One-year client retention rate; 7. Five-year client retention rate; 8. Non-institutional discretionary and/or non-discretionary client assets administered; 9. Number of client households served; 10. Education and professional designations. Wealth managers do not pay a fee to be considered or placed on the final list of Five Star Wealth Managers. Award does not evaluate quality of services provided to clients. Once awarded, wealth managers may purchase additional profile ad space or promotional products. The Five Star award is not indicative of the wealth manager’s future performance. Wealth managers may or may not use discretion in their practice and therefore may not manage their client’s assets. The inclusion of a wealth manager on the Five Star Wealth Manager list should not be construed as an endorsement of the wealth manager by Five Star Professional or this publication. Working with a Five Star Wealth Manager or any wealth manager is no guarantee as to future investment success, nor is there any guarantee that the selected wealth managers will be awarded this accomplishment by Five Star Professional in the future. For more information on the Five Star award and the research/selection methodology, go to fivestarprofessional.com. 3,619 Boston area wealth managers were considered for the award; 566 (16 percent of candidates) were named 2019 Five Star Wealth Managers. 2018: 2,819 considered, 532 winners; 2017: 2,467 considered, 623 winners; 2016: 2,530 considered, 632 winners;2015: 3,542 considered, 801 winners; 2014: 1,707 considered, 655 winners; 2013: 2,362 considered, 713 winners; 2012: 2,591 considered, 454 winners